Intro

Have you ever wondered:

- How has the sales price of T4 apartments in the city of Porto evolved over the past 15 years?

- What is the net yield of a prime apartment in Lisbon?

- What is the rent which the commercial unit next door was rented out for last year?

- What are the forecasts for residential prices in secondary locations of Lisbon?

- What are the benchmarks for ancillary costs for office space?

If you came to Portugal from one of the countries with a high level of transparency in the real estate market, like England, France, Australia or the USA, you probably have already unsuccessfully searched for data on these or similar questions.

Despite Portugal’s recent evolution in market transparency, foreigners from more transparent countries should take extra care of understanding and managing the differences.

Although real estate market transparency cannot be changed much by an individual, every buyer should familiarise themselves with the market environment they act within. Knowing what you are getting into before logging in your capital is crucial. In many countries, and Portugal is no exception, foreigners often make naïve decisions and enter unnecessary risk and costs.

Transparent markets vs. opaque markets

In one sentence, the difference between transparent and opaque real estate markets is the availability of information.

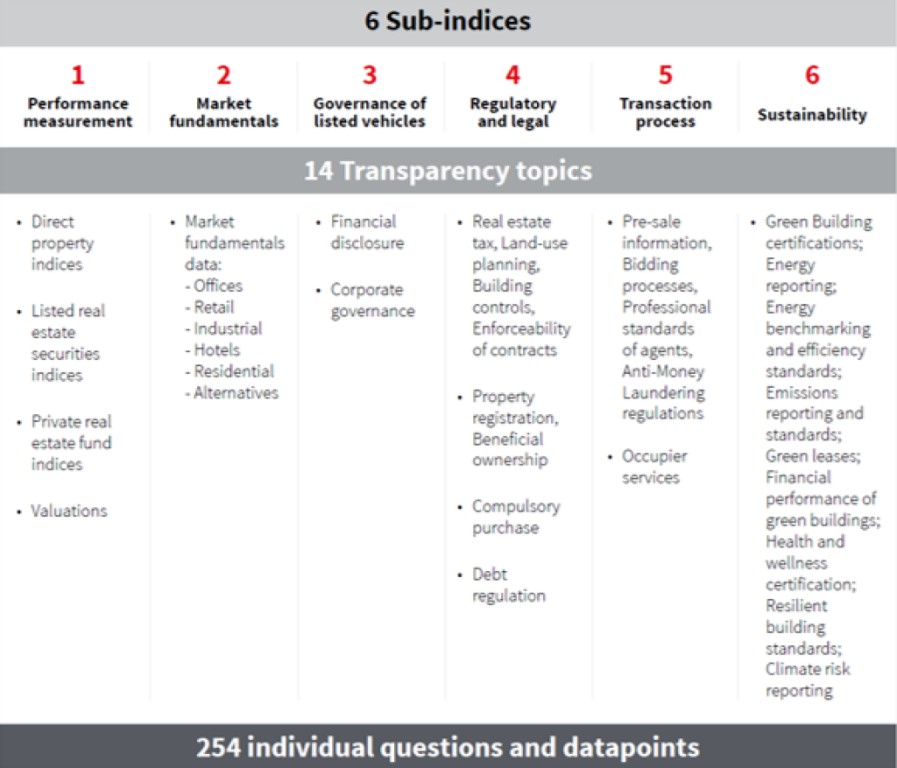

In transparent markets you will easily find reliable, detailed and standardised information for the present and past. In opaque property markets that information is rare, often has no standardised definition or underlying calculations, refers to wider geographies rather than to micro locations and the historic equivalent is only available for a few years rather than two or more decades. The leading publication to evaluate and report on the transparency level of the worlds real estate market is JLLs Global Transparency Index. The main factors it assesses reflects quite well what makes the difference:

Market participants often notice differences for the first time when they get in contact with real estate professionals. More transparent markets are much more professionalised, have higher access barriers for advisors, tighter regulations of provided services and higher clarity and efficiency in all aspects of service delivery.

Why does it matter for you as a buyer?

As mentioned in various posts on Real Estate Bricks, real estate investment is all about risks and returns. Market participants need to understand and try to minimise an investments risk while figuring out and trying to maximise the respective returns.

An investor, who prepares to make an investment, for instance, will do a thorough analysis of the market, the potential investment, its tenancy as well as the expected costs and income in the future. To do this data on all aspects will be needed. The more reliable data there is, the better and more realistic the analysis will be.

Reversely, this means that, in an opaque market, the assessment of risks and returns becomes vague and often nearly impossible. This creates market inefficiencies and risk for all market participants.

This does not necessarily mean that you should only invest in transparent market. Great gains can be made despite and often because of opacity. However, you should always understand as much as possible about a potential investment, its market and how it relates to your personal risk-return-profile.

What is the level of transparency in the property market in Portugal?

Portugal has been categorised by JLL as a transparent market (second best of five categories) market for the past 12 years. It was on place 19 of 81 in 2010 and currently holds 24 of 94.

However, what should be noted is that Portugal improved its score from 1.82 (2010) to 2.37 (2022) on a scale of 1.00 to 5.00 with 1.00 being the best.

On one hand this is in line with the global trend – most countries’ transparency score improved. On the other hand, this is also the result of measures and trends specific to Portugal, as, for example, improvements in laws and regulations, increasing foreign investment and a constant rise of market activity.

Here are some of the countries from which people have moved in high numbers to Portugal in comparison:

| Rank (1-94) | Country | Score 2022 |

| 1 | United Kingdom | 1.25 |

| 2 | United States | 1.34 |

| 3 | France | 1.34 |

| 9 | Germany | 1.76 |

| 16 | Hong Kong SAR | 1.98 |

| 24 | Portugal | 2.37 |

| 30 | China (Shanghai and Beijing) | 2.54 |

| 35 | Israel | 2.66 |

| 44 | Brazil | 2.97 |

| 79 | Angola | 4.30 |

Note that within all countries, there can be significant differences between sub-markets. A sub-market could be, for instance, a geography (e.g. London City) or a real estate asset class (e.g. residential Netherlands).

Those differences of transparency within countries are often results of a high number of listed companies or funds (since they are obliged to collect and publicise lots of information) doing many transactions and maintaining portfolios of specific assets. Another factor is foreign investment, since investors from more transparent markets not only demand more information, but also produce (through transactions), collect and share more information when they enter the more opaque markets. Within Portugal, the more transparent sub-market are Lisbon and the Algarve with residential, offices and hotels being the most transparent use-types.

Conclusion

Real estate market transparency can vary a lot between countries. Overlooking these or not taking them seriously can create unnecessary risks to your investment. It is important to understand that many of the factors that impact this are macro factors, meaning they are not very obvious when analysing a single apartment or building, but the impact can be large and long lasting.

As an investor, you should always be aware and work out your appropriate risk-return-profile.

Also, keep in mind that the less transparent a market is, the more experience and informal information matter. Therefore, try to work with experienced local advisors, because their skills and knowledge can reduce gaps that publicly available knowledge leaves.

If you would like to understand your personal risk-return-profile and if investing in Portugal is suitable for you and your investment goals, we can assist or refer you to an expert.

Contact RCP to discuss a potential service proposal or get linked to respective experts.

In case we put you in business with 3rd-party servicers we may collect a referral fee from them.

Further reading on the topic in English

The above combines the references publication with the authors primary and secondary research as well as his professional experience.

A good read (in English) on the topic is: